Macroeconomics Perspective

The manufacturing sector across the world has been affected by policy failures that have contributed to the recent global financial crisis, which has damaged the global competitiveness of individual countries (Keat, Young, Erfle, 2013). Nevertheless, countries such as the U.S. and South Korea have managed to register favorable rates of recovery over the recent years, and this trend has become a vital success edge for both economies. By its nominal gross domestic product (GDP), the U.S. is recognized as the largest economy in the world. Its most recent GDP per capital is $ 48,401.43 in purchasing power-adjusted dollar terms (quandl.com, 2015a). Conversely, the score of economic freedom in South Korea is 71.5, which makes its economic sector to be the 29th freest region in terms of the 2015 index (heritage.org, 2015). This paper critically analyzes the macroeconomic factors in the U.S. and South Korea that may affect the long-term financial performance of AutoEdge.

Macroeconomic Factors in the U.S

According to the Federal Reserve’s report released on December 2, 2015, economic activity in most parts of the country has been rising at a modest pace. Growth in consumer spending and aggregate economic activities in such districts as New York were sluggish, while those in San Francisco and Minneapolis were moderate. The current GDP at market prices in the U.S. is $17.42 trillion, while the total population is 318.9 million (federalreserve.gov, 2015). Although there were reports of increased revenue, statistics showed that the manufacturing sector reported some mixed outcomes over the recent weeks. This is as a result of low commodity prices, strong dollar value, and weak international demand that were reported in several districts.

In the manufacturing sector where AutoEdge operates, there was a robust increase in the sales of light vehicles. Low prices of gasoline played a major role in boosting the sales of both larger vehicles and light trucks in most Districts. This implies that consumer spending on automobiles helped the inventory level to remain satisfactory. The current rate of inflation in the U.S. calculated on the basis of the change in consumer price index (CPI) was 1.46%, while the rate of unemployment in 2015 was 5.10%. A huge percentage of the economy is mainly service-based with the industrial and manufacturing sectors employing 16.70% of the population and accounting for 20.50% of the GDP (quandl.com, 2015a). On the other hand, the service sector employs 81.20% of the population and accounts for 78.05% of the GDP. The government’s revenue was 31.43% of the GDP, while the total amount of spending by the government was 36.77% of the GDP. The total amount of government debt currently stands at 82.06% of the GDP.

The balance of payment (BOP) records the total amount of transactions the U.S. residents conduct with other foreign countries (Keat et al., 2013). The total amount of BOP as of August 2015 was -$43,330.00, with the negative figure indicating that the country had purchased more goods and services than it had actually exported. For every one that the U.S. spends in the manufacturing sector, $1.40 is simultaneously added to the general economy (nam.org, 2016). This the highest multiplier effect in the country among all economic sectors, and it provides AutoEdge with a wonderful opportunity of investing in the U.S.

Research studies have shown that a huge percentage of manufacturing firms in the U.S. is actually in small scale businesses. Recent data indicates that there are close to 256,363 manufacturing companies, with only 3,626 firms employing more than 500 workers. This trend implies that the majority of them, which is more than three-quarters, has less than 20 workers. Currently, the manufacturing sector in the U.S. employs 12.32 million workers, which accounts for 9% of the entire workforce. Furthermore, the manufacturing sector supports additional 18.5 million jobs, which is approximately one in six jobs in the private sector (quandl.com, 2015a). The average employee in the manufacturing sector was paid $79,553 per year, while the average employee in any other industry was paid $64,204. When focusing on wages, the employee in the manufacturing sector was paid $25.19 per hour including benefits.

Over the years, manufacturers have witnessed the salary scale of their workers rise tremendously, which has made them to be very competitive across the globe. For instance, among all employees in the manufacturing sector, output per hour has increased by over 2.5% which is more than 1.7 times compared to all nonfarm sectors. Manufacturers of durable goods, such as in the automobile producers, have witnessed the greatest growth, and it has enabled automobile companies to reap a great rate of labor productivity over the recent years (Keat et al., 2013). In addition, exports of manufactured goods from the U.S. have more than quadrupled. By 2014, exports reached an all-time high of $1.403, which is consecutive growth in the last five years. However, exports in 2015 were dampened by a number, with the value declining by 4.2% in the first two quarters of the year.

Nevertheless, new trade agreements are playing a significant role when it comes to opening new markets. Manufacturing trade surplus in the U.S. reached an all-time high of $55 billion, compared to a deficit of $572 billion that was experienced in other countries. Almost half of all manufactured products are exported to countries with which the U.S. has entered into free trade agreements (FTAs). Manufacturers managed to export products that were worth $674.9 billion to FTA nations, which was up by 48.1% compared to last year (quandl.com, 2015a). Foreign direct investment that concentrates in the manufacturing sector surpasses $1 trillion and these values were first achieved in 2014. Studies have shown that these values have been increasing at a rapid rate, and experts estimate that the sector will continue to grow as a result of the ventures that have already been announced over the recent years.

Macroeconomic Indicators in South Korea

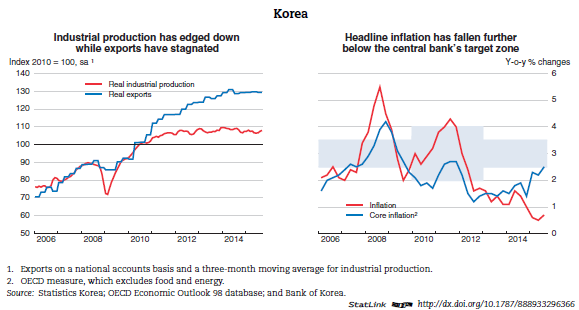

Korea’s economy was severely affected by two major shocks in 2015, which include the outbreak of the Middle East Respiratory Syndrome (MERS) and reduced demand from the Asian countries, particularly China. These changes led to two and three-quarters decline in output growth. Although the country managed to resolve the MERS outbreak, weak demand for Korean products in the Asian countries continues to pull down recovery in output. However, AutoEdge can still benefit by investing in South Korean economy as a result of projected increase in private consumption expenditure. Experts estimate that increase in consumption will lead to a 3% increase in output growth in 2016 and a 3.5% increase in 2017 (OECD, 2015). Inflation is also estimated to increase to 2%.

Studies have shown that the fiscal stimulus in 2015 will also be supplemented by additional measures that will be implemented in 2016. Due to the fact that inflation will still be below the range that has been targeted of between 2.5% and 3.5%, analysts are of the opinion that reduction in policy interest rates will be of huge benefit to South Korea (OECD, 2015). Wide ranging structural reforms are also expected to be a top priority in the country. They will encompass the 2014 Three-year Plan for Economic Innovation that will be influential in sustaining the growth potential in South Korea. It will make economic growth more inclusive even with the rapidly growing population.

Economic outlook in South Korea (OECD, 2015)

Basically, South Korea is considered as a wealthy nation with a GDP of $1,217.80 billion, which puts it among the 15 largest economies in the world. Its GDP increased by 2.77%, while its GDP per capita was 27,909 in terms of purchasing power adjusted USD. The unemployment rate in South Korea was 4.5%, while the rate of inflation was 1.31% as calculated in terms of changes in the consumer price index (quandl.com, 2015b). Research studies have also shown that its economy is mainly service-based. Statistics indicate that the sector employs 76.40% of the workforce and accounts for 59.11% of the GDP.

Conversely, the industrial and manufacturing sectors employ 17.00% of the workforce and account for 38.55% of the GDP. Governmental revenue was 23.64% of the GDP, while spending was 21.48%. The total debt of the government was 36.02% of the GDP. As of 2015, the exchange rate was 1,127.20 Korean Republic Won (KRW) per 1 USD. The rate of unemployment was 3.4%, while the rate of inflation reached 0.50% by the end of 2015 (quandl.com, 2015b). The BOP as of 2015 was 5,530, which indicates that South Korea managed to export more goods and service than it imported. Its current accounts stood at 6,940.00 and the current account as a share of its GDP was 5.79%.

Revised 2015 statistics proved that the South Korean economy actually rebounded in the third quarter and managed to expand by 2.7% per year. This growth was spurred by powerful domestic dynamics, despite the fact that the external forces, such as low demand from the Asian countries, continued to be a significant drag. Recent data also showed that Korea will continue to struggle in the fourth quarter of 2015 due to low momentum (focus-economics.com, 2015). However, in November, consumer confidence managed to reach its annual high in November, a fact that paints a bright future for AutoEdge to invest in the manufacturing sector.

When it comes to export, the value contracted and the business confidence continued to be stuck in the pessimistic region. It was a result of the deterioration in the sentiments that pertained to export-oriented companies. The South Korean government implemented fiscal stimulus policies which boosted the economy and reversed the deteriorating sentiments and fading exports. Studies have shown that the poor performance of the export sector is mainly influenced by the fact that China and other Asian countries are yet to report significant success in their recovery process, which in turn negatively affects the economic performance of South Korea. The Korean population currently stands at 50.4 million, while its GDP per capita by the end of 2015 was $26,796 (focus-economics.com, 2015). Its GDP in used dollars was 1,351 billion, while its rate of economic growth in terms of annual variation was 3.3%. The annual variation of its stock market was valued at -4.8, while its policy interest rate was 2.00%.

Conclusion

This document has critically analyzed the macroeconomic variables in the U.S. and South Korea and their potential of affecting AutoEdge’s long-term financial performance. From the above analysis, it is evident that the manufacturing sectors in both countries have been significantly affected by both internal and external factors. Nevertheless, both countries have shown strong indications of recovery, which is a sign that AutoEdge can make a bold move and succeed by investing in these economies. The fact that manufacturing employees are compensated well has led to increased productivity, an important change that increases the competitiveness of firms. AutoEdge can also exploit several opportunities that are utilized by other small manufacturing firms located in both countries.